Non current liabilities are referred to as the long term debts or financial obligations that are listed on the balance sheet of a company. These are also known as long term liabilities. These obligations are not due within twelve months or accounting period as opposed to current liabilities, which are short-term debts and are due within twelve months or the accounting period.

Most of the businesses, compare non current liabilities amount with cash flow, to understand if an organisation has enough financial resources to meet the financial obligations over a long-term. Most of the moneylenders invest on short-term liquidity and the current liabilities amount, however, the long-term investors check non current liabilities to estimate whether they can invest money in the company. If the company’s cash flow is more, it indicates that the company can support more debt without being in default.

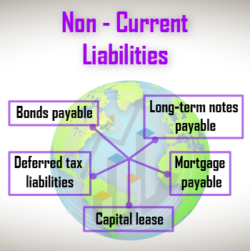

Non Current Liabilities Examples:

Mentioned below are few non current liabilities examples :

- Debentures

- Bonds payable

- Long-term loans

- Deferred tax liabilities

- Long-term lease

- Pension benefit obligations

- Deffered Revenue

The non current liabilities are listed individually away from current liabilities in a company’s balance sheet.

The above mentioned is the concept, that is elucidated in detail about ‘What are Non Current Liabilities?’ for the Commerce students. To know more, stay tuned to BYJU’S.

Important Topics in Accountancy:

I want to get more knowledge from your site, this site is very helpful for any students who want to learn